Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, is once again positioning himself for what many are calling the "inevitable market crash." Known for his unparalleled wisdom and contrarian approach, Buffett’s anticipation of market downturns has often led to some of the most profitable investments in history. As the world braces for potential economic turbulence, all eyes are on the Oracle of Omaha to see how he plans to navigate these uncertain waters.

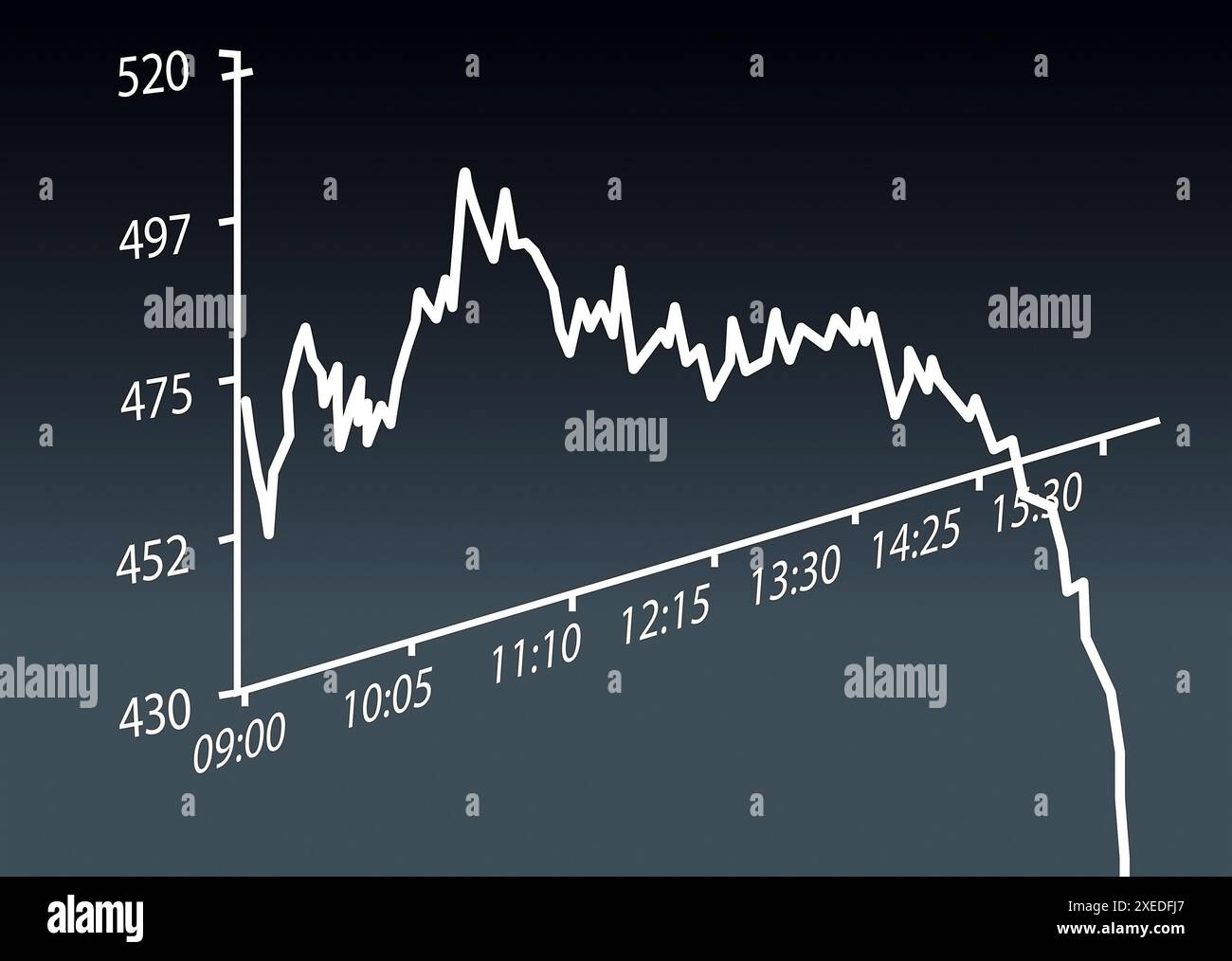

Imagine this: the stock market is like a rollercoaster ride that no one knows when it will plummet. While most investors panic and sell off their holdings, Buffett sees opportunity. He’s not just waiting for the crash; he’s preparing for it. With a war chest of cash and a long-term vision, Buffett is ready to swoop in and buy undervalued assets at bargain prices. This is the essence of value investing, a strategy that has made him one of the wealthiest individuals on the planet.

But why should you care about what Warren Buffett does? Well, because his moves often set the tone for the entire market. When Buffett makes a big acquisition or increases his stake in a company, it sends ripples through the financial world. Investors take notice, analysts dissect his decisions, and the media goes into overdrive. So, if you’re looking to understand how to weather a market storm, there’s no better teacher than the man who’s been doing it for over six decades.

Read also:Drivewithflexcom Reviews The Ultimate Guide To Ridesharing In 2023

Who is Warren Buffett?

Before we dive into Buffett’s strategies for a market crash, let’s take a moment to understand the man behind the legend. Warren Buffett was born on August 30, 1930, in Omaha, Nebraska. From a young age, he showed an uncanny knack for numbers and an insatiable appetite for business. By the time he was 11, he had already purchased his first stock. Fast forward a few decades, and Buffett has become synonymous with investing success.

But here’s the kicker: Buffett didn’t just get lucky. He built his fortune through discipline, patience, and an unshakable belief in the power of compounding. Unlike many modern investors who chase quick gains, Buffett focuses on identifying companies with strong fundamentals and buying them when they’re trading below their intrinsic value. It’s a strategy that has stood the test of time.

Biography of Warren Buffett

| Full Name | Warren Edward Buffett |

|---|---|

| Birth Date | August 30, 1930 |

| Place of Birth | Omaha, Nebraska, USA |

| Net Worth | $118 billion (as of 2023) |

| Occupation | Investor, Businessman, Philanthropist |

| Known For | Chairman and CEO of Berkshire Hathaway, Value Investing |

Why Buffett Awaits Market Crash Moves

Now, let’s talk about why Buffett is so eager to pounce on market crashes. It’s not because he enjoys watching people lose money; quite the opposite, actually. Buffett views market downturns as opportunities to buy high-quality companies at discounted prices. Think of it like this: when everyone else is selling out of fear, Buffett is buying with confidence. It’s a counterintuitive approach, but it’s one that has worked wonders for him over the years.

Here’s a little secret: Buffett doesn’t predict market crashes. He doesn’t have a crystal ball or insider information. What he does have is a massive amount of cash on hand and the willingness to act when others are paralyzed by fear. This cash reserve, often referred to as Berkshire Hathaway’s "powder keg," allows Buffett to make bold moves when the time is right.

The Psychology of Market Crashes

Market crashes can be terrifying for the average investor. You wake up one morning, check your portfolio, and suddenly, half your wealth seems to have vanished. It’s enough to make anyone panic. But here’s the thing: panic selling is one of the worst things you can do during a market crash. Why? Because you’re locking in your losses.

Buffett understands this all too well. That’s why he famously said, "Be fearful when others are greedy, and greedy when others are fearful." When everyone else is selling, Buffett is buying. He’s not afraid to go against the herd because he knows that the market will eventually recover. And when it does, those who bought at the bottom will reap the rewards.

Read also:Zamboni Nightclub Nyc The Ultimate Spot For Latenight Vibes

Buffett’s Strategy During a Market Crash

So, what exactly does Buffett do during a market crash? Let’s break it down:

- Cash is King: Buffett always keeps a substantial amount of cash on hand. This gives him the flexibility to act quickly when opportunities arise.

- Focus on Fundamentals: During a crash, Buffett looks for companies with strong fundamentals. He’s not interested in speculative stocks or companies with shaky business models.

- Buy Low, Sell High: This may sound obvious, but it’s a principle that many investors forget. Buffett buys when prices are low and sells when they’re high.

- Patient Investing: Buffett doesn’t expect overnight returns. He’s in it for the long haul, which is why he can afford to wait for the market to recover.

These strategies may seem simple, but they require a level of discipline and patience that most investors lack. That’s why Buffett stands out from the crowd.

Examples of Buffett’s Market Crash Moves

Let’s take a look at some examples of Buffett’s market crash moves:

- 2008 Financial Crisis: During the 2008 financial crisis, Buffett invested in companies like Goldman Sachs and General Electric. These investments paid off handsomely as the market recovered.

- 2020 Pandemic Crash: When the pandemic hit in 2020, Buffett increased his stake in Apple, a company he had already been invested in. This move proved to be incredibly profitable as Apple’s stock soared in the following months.

These examples illustrate Buffett’s ability to identify undervalued assets and make bold moves when others are hesitant.

How Buffett Evaluates Companies

When Buffett evaluates a company, he looks at several key factors:

- Moat: Does the company have a competitive advantage that sets it apart from its competitors?

- Management: Is the company run by competent and trustworthy leaders?

- Valuation: Is the company trading below its intrinsic value?

- Long-Term Prospects: Does the company have a bright future ahead of it?

By focusing on these factors, Buffett is able to identify companies that are likely to succeed over the long term. It’s a rigorous process, but one that has proven to be highly effective.

Buffett’s Favorite Metrics

Buffett relies on several key metrics to evaluate companies:

- Return on Equity (ROE): This measures how efficiently a company uses its shareholders’ equity to generate profits.

- Earnings Per Share (EPS): This shows how much profit a company generates for each share of stock.

- Price-to-Earnings (P/E) Ratio: This compares a company’s stock price to its earnings per share.

These metrics help Buffett determine whether a company is undervalued or overvalued. It’s a crucial part of his investment process.

Lessons from Buffett’s Market Crash Moves

What can we learn from Buffett’s approach to market crashes? Here are a few key takeaways:

- Stay Calm: Panic selling is rarely a good idea. Instead, focus on the long-term prospects of your investments.

- Do Your Homework: Before investing in a company, make sure you understand its business model and financials.

- Be Patient: Investing is a marathon, not a sprint. Don’t expect overnight success.

These lessons may seem simple, but they’re essential for anyone looking to navigate a market crash successfully.

The Importance of Emotional Intelligence

Emotional intelligence is just as important as financial knowledge when it comes to investing. Buffett understands that emotions can cloud judgment, which is why he remains calm and rational during market turmoil. By controlling his emotions, Buffett is able to make better decisions than those who let fear or greed take over.

How to Prepare for a Market Crash

If you’re an investor, it’s never too early to start preparing for a market crash. Here are a few tips:

- Build a Cash Reserve: Like Buffett, you should always have some cash on hand to take advantage of opportunities when they arise.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

- Stay Educated: Keep learning about investing and the markets. The more you know, the better equipped you’ll be to handle a crash.

By following these tips, you’ll be in a much better position to weather a market storm.

Common Mistakes to Avoid

Here are a few common mistakes to avoid during a market crash:

- Panic Selling: Selling out of fear can lock in your losses and prevent you from benefiting from a market recovery.

- Chasing Trends: Following the latest investment trends can lead to poor decision-making. Stick to your long-term strategy.

- Overleveraging: Borrowing too much money to invest can amplify your losses during a crash.

Avoiding these mistakes can help you preserve your wealth and position yourself for future success.

Conclusion

In conclusion, Warren Buffett’s approach to market crashes is a masterclass in contrarian investing. By staying calm, focusing on fundamentals, and acting with discipline, Buffett has been able to turn market downturns into opportunities for growth. As the world braces for the next market crash, investors would do well to take a page from Buffett’s playbook.

So, what can you do next? Start by building a cash reserve, diversifying your portfolio, and educating yourself about the markets. And remember, when the market crashes, don’t panic. Instead, follow Buffett’s advice: be greedy when others are fearful.

Finally, I’d love to hear your thoughts on this topic. Have you ever navigated a market crash? What strategies did you use? Leave a comment below and let’s start a conversation. And if you found this article helpful, don’t forget to share it with your friends and family. Together, we can all learn from the wisdom of the Oracle of Omaha.

Table of Contents

- Why Buffett Awaits Market Crash Moves

- The Psychology of Market Crashes

- Buffett’s Strategy During a Market Crash

- Examples of Buffett’s Market Crash Moves

- How Buffett Evaluates Companies

- Buffett’s Favorite Metrics

- Lessons from Buffett’s Market Crash Moves

- The Importance of Emotional Intelligence

- How to Prepare for a Market Crash

- Common Mistakes to Avoid