Mark Cuban, the billionaire entrepreneur, is sounding the alarm bells about tariffs and the risk of a 2008-style financial crisis. But what exactly is he talking about? And how does DOGE fit into all of this? Let’s dive deep into the world of tariffs, cryptocurrencies, and economic risks, because it’s time to understand what’s really going on before it’s too late!

Imagine this: you’re cruising through life, thinking everything’s peachy, and then BAM—someone like Mark Cuban comes along and says, “Hey, we might be heading toward another 2008 financial crisis.” Now, if you’re anything like me, your first thought is probably, “Wait… what?!” But before you start panicking, let’s break it down. Cuban isn’t just throwing random words out there; he’s pointing to some serious issues that could have far-reaching consequences.

This isn’t just about tariffs or DOGE (yes, that meme coin you’ve probably heard of). It’s about understanding the bigger picture—the interconnectedness of global economies, the role of cryptocurrencies, and how all of this could lead us down a path we’ve seen before. So buckle up, because we’re about to take a ride through the world of economics, geopolitics, and crypto.

Read also:Mashed Potatoes And Gravy Near Me A Comfort Food Journey You Cant Miss

Here’s a quick roadmap of what we’ll cover:

- What Are Tariffs and Why Should You Care?

- The Economic Risk: Could We See a 2008 Repeat?

- Mark Cuban’s Perspective on Tariffs

- DOGE’s Role in the Financial Landscape

- A Historical Context: Lessons from 2008

- The Global Impact of Tariffs

- The Rise of Cryptocurrencies as an Alternative

- Investor Strategy: Cutting Risks in Uncertain Times

- Government Responses to Tariffs and Crypto

- Conclusion: What’s Next for the Economy?

What Are Tariffs and Why Should You Care?

Tariffs, my friend, are essentially taxes on imported goods. Think of them as a way for governments to protect their own industries by making foreign products more expensive. Sounds simple enough, right? But here’s the kicker: tariffs can set off a chain reaction that affects everyone—from big corporations to everyday consumers.

When tariffs go up, companies often pass those costs onto consumers in the form of higher prices. This means you might end up paying more for everything from electronics to groceries. And if enough industries are affected, it can lead to inflation, slower economic growth, and even job losses. So yeah, tariffs matter—a lot.

Now, let’s talk about why Cuban is so concerned. He believes that the current tariff policies could create a domino effect, destabilizing the economy and potentially leading to a repeat of the 2008 financial crisis. But before we get into that, let’s explore the economic risks in more detail.

The Economic Risk: Could We See a 2008 Repeat?

Remember 2008? The housing market crashed, banks failed, and millions of people lost their jobs. It was a financial disaster that left scars on the global economy for years. Cuban is warning that similar conditions could arise again, thanks to a combination of factors, including tariffs, inflation, and unstable financial markets.

Here’s the deal: when tariffs disrupt global trade, it can lead to a slowdown in economic activity. Add to that rising interest rates, volatile stock markets, and geopolitical tensions, and you’ve got a recipe for disaster. The 2008 crisis was largely caused by risky lending practices and a lack of regulation, but today’s risks are different—and maybe even more complex.

Read also:Buenos Diacuteas De Navidad A Festive Greeting That Warms Your Heart And Soul

So, what does this mean for you? Well, if history is any indication, it’s a good idea to start thinking about how you can protect your finances in case things take a turn for the worse. And that’s where DOGE comes in—or at least, that’s what some people think.

Mark Cuban’s Perspective on Tariffs

Mark Cuban isn’t just any guy with an opinion—he’s a billionaire who’s built his fortune through smart investments and a deep understanding of how the economy works. When he talks about tariffs, people listen. So what’s his take on the matter?

Cuban believes that tariffs are a short-sighted solution to long-term problems. By imposing tariffs on imported goods, governments may temporarily boost certain industries, but they also risk alienating trading partners and sparking trade wars. And as we’ve seen in the past, trade wars rarely end well for anyone.

He’s also concerned about the impact of tariffs on small businesses and consumers. When prices go up, people have less disposable income, which can lead to a decrease in consumer spending—a key driver of economic growth. In short, Cuban thinks tariffs are a risky move that could backfire in a big way.

DOGE’s Role in the Financial Landscape

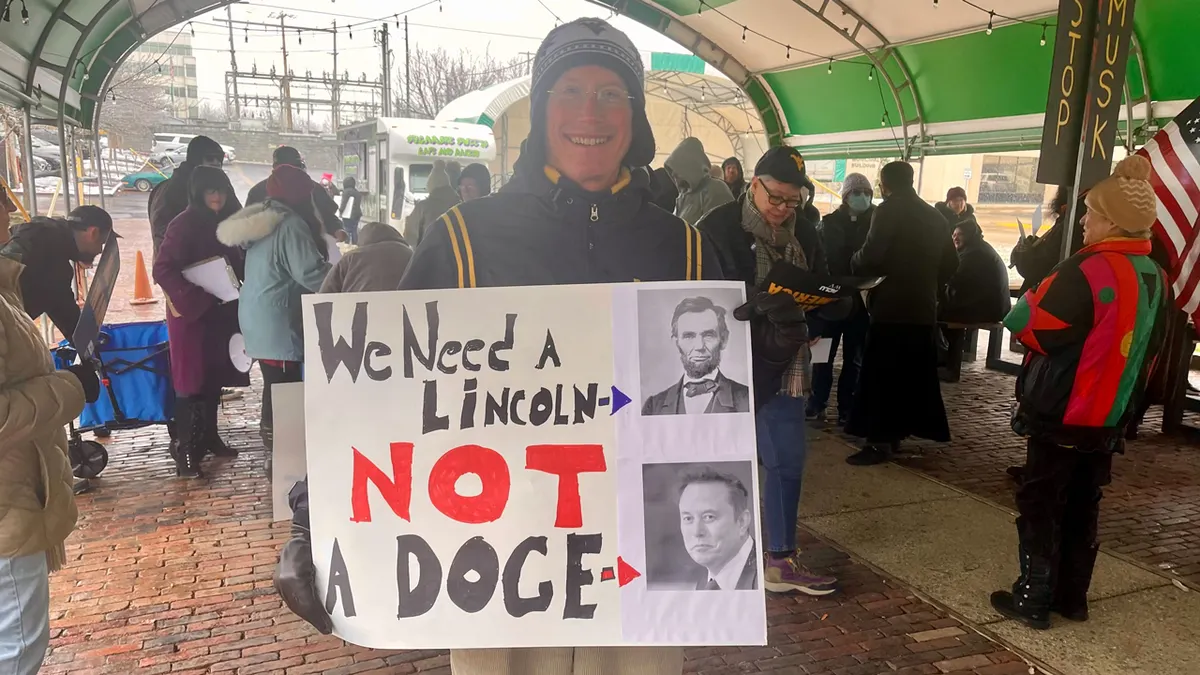

Now, let’s talk about DOGE—the meme coin that’s become a household name (well, maybe not in every household, but you get the idea). DOGE started as a joke, but it’s since evolved into a legitimate player in the cryptocurrency world. And according to some experts, it could play a role in mitigating the risks posed by tariffs and other economic challenges.

Here’s why: cryptocurrencies like DOGE offer an alternative to traditional financial systems. They’re decentralized, meaning they’re not controlled by any single government or institution. This makes them an attractive option for people who are worried about the stability of their local currencies or the reliability of their banks.

Of course, cryptocurrencies come with their own set of risks. They’re highly volatile, and their value can fluctuate wildly in a matter of hours. But for some investors, the potential rewards outweigh the risks, especially in uncertain times like these.

A Historical Context: Lessons from 2008

Before we move on, let’s take a moment to reflect on the lessons we learned from the 2008 financial crisis. Back then, the housing market bubble burst, sending shockwaves through the global economy. Banks that had invested heavily in risky mortgage-backed securities found themselves in trouble, and many had to be bailed out by taxpayers.

What can we learn from this? First, it’s important to be aware of the risks inherent in any financial system. Second, diversification is key—don’t put all your eggs in one basket. And third, don’t underestimate the power of government policies to either help or harm the economy.

Fast forward to today, and we’re facing a new set of challenges. Tariffs, inflation, and geopolitical tensions are all putting pressure on the global economy. But unlike in 2008, we now have tools like cryptocurrencies that can help us navigate these uncertain waters.

The Global Impact of Tariffs

Tariffs don’t just affect one country—they have a ripple effect that can be felt around the world. When one country imposes tariffs on another, it can lead to retaliatory measures, trade wars, and a general slowdown in global trade. And as we’ve seen in recent years, this can have serious consequences for businesses and consumers alike.

For example, when the U.S. imposed tariffs on Chinese goods, China responded by imposing its own tariffs on American products. This created a cycle of escalating tensions that hurt both countries’ economies. And it’s not just the U.S. and China—other countries have also been drawn into the fray, leading to a more fragmented global trading system.

So what can be done to break this cycle? That’s a question that policymakers, economists, and investors are still grappling with. But one thing is clear: the status quo isn’t working, and something needs to change.

The Rise of Cryptocurrencies as an Alternative

As we’ve already discussed, cryptocurrencies like DOGE are becoming increasingly popular as an alternative to traditional financial systems. But why is this happening now? And what does it mean for the future of money?

There are a few reasons why cryptocurrencies are gaining traction. First, they offer a level of anonymity and security that traditional banking systems can’t match. Second, they’re decentralized, meaning they’re not subject to the whims of governments or central banks. And third, they’re highly innovative, with new use cases being developed all the time.

Of course, cryptocurrencies aren’t without their challenges. They’re still largely unregulated, which makes them vulnerable to fraud and manipulation. And as we’ve seen with DOGE, their value can be driven more by speculation than by any inherent value. But despite these risks, many people believe that cryptocurrencies represent the future of money—and they may be right.

Investor Strategy: Cutting Risks in Uncertain Times

If you’re an investor, you’re probably wondering how you can protect your portfolio in uncertain times. Here are a few strategies to consider:

- Diversify your investments across different asset classes, including stocks, bonds, and cryptocurrencies.

- Keep an eye on geopolitical developments and adjust your strategy accordingly.

- Consider hedging against inflation by investing in commodities like gold or silver.

- Stay informed about tariff policies and their potential impact on your investments.

Remember, the key to successful investing is to stay calm and make informed decisions. Don’t let fear or greed drive your actions—stick to a well-thought-out strategy, and you’ll be in a better position to weather any storms that come your way.

Government Responses to Tariffs and Crypto

So far, we’ve talked a lot about tariffs and cryptocurrencies, but what are governments doing about all of this? The truth is, it’s a mixed bag. Some countries are embracing cryptocurrencies, while others are cracking down on them. And when it comes to tariffs, there’s still a lot of debate about the best course of action.

For example, the U.S. has been actively imposing tariffs on a range of goods, citing national security concerns and a desire to protect domestic industries. But other countries have pushed back, arguing that tariffs are counterproductive and harm everyone involved. Meanwhile, some governments are exploring the use of digital currencies as a way to modernize their financial systems and reduce reliance on traditional banking.

As these debates continue, one thing is clear: the global economy is at a crossroads. Will we continue down the path of protectionism and tariffs, or will we embrace a more open and interconnected world? Only time will tell.

Conclusion: What’s Next for the Economy?

So there you have it—a deep dive into the world of tariffs, cryptocurrencies, and economic risks. Mark Cuban may be sounding the alarm bells, but that doesn’t mean we’re doomed. By staying informed and making smart decisions, we can navigate these uncertain times and come out stronger on the other side.

Here’s a quick recap of what we’ve covered:

- Tariffs can have far-reaching consequences for the global economy.

- The risk of a 2008-style financial crisis is real, but not inevitable.

- Cryptocurrencies like DOGE offer an alternative to traditional financial systems.

- Diversification and informed decision-making are key to protecting your investments.

Now it’s your turn. What do you think about tariffs and cryptocurrencies? Are you worried about the risks, or do you see opportunities in this changing landscape? Leave a comment below, share this article with your friends, and let’s keep the conversation going. Because when it comes to the economy, we’re all in this together.