So, here's the deal folks. You've probably heard the term CPI thrown around in financial news, economic reports, and even casual conversations. But what exactly is CPI? Think of it like this: CPI, or Consumer Price Index, is kinda like the invisible hand that controls the price of everything you buy. From your morning coffee to that fancy gadget you just had to have, CPI is the big boss behind the scenes. It's the pulse of the economy, and understanding it can help you make smarter financial decisions. So, buckle up, because we’re diving deep into the world of CPI.

Now, before we get too far ahead of ourselves, let’s break it down. CPI isn't just some random number economists pull out of thin air. It’s a carefully calculated metric that tracks changes in the price of goods and services over time. It’s like a report card for the economy, showing how prices are moving and whether inflation is creeping up on us. And trust me, inflation is something you don’t want to ignore. It affects your wallet, your savings, and even your long-term financial plans.

What makes CPI so fascinating is how it touches every corner of our lives. Whether you're a student trying to stretch your budget, a business owner trying to keep costs down, or an investor looking for the next big opportunity, CPI is your secret weapon. In this article, we’ll unpack everything you need to know about CPI, from its basics to its impact on the global economy. So, let’s get started, shall we?

Read also:Pasteles De 8 Pulgadas The Ultimate Guide To Savoring Latin Flavor

What Exactly is CPI?

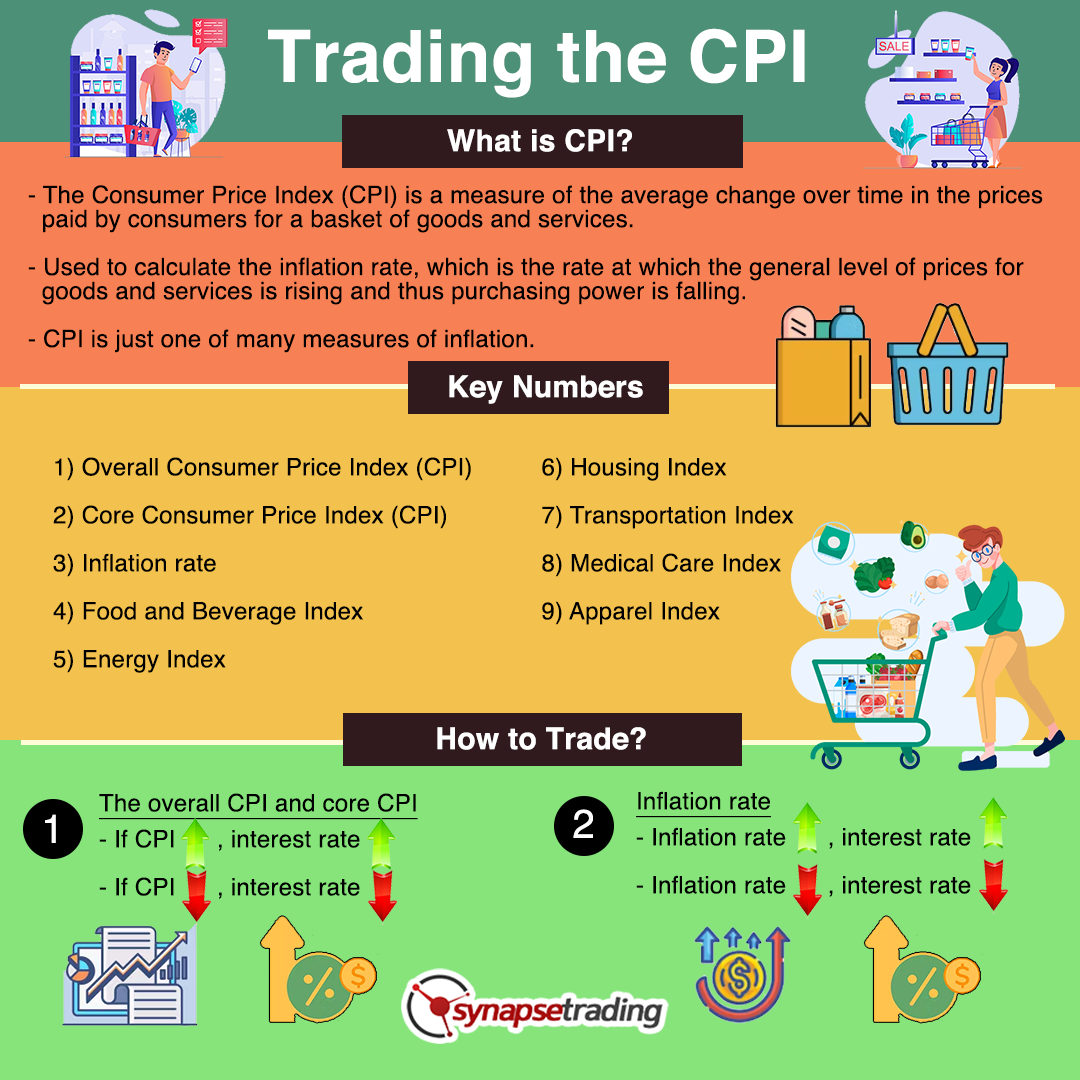

In plain English, CPI stands for Consumer Price Index. It’s a measure used by governments and economists to track changes in the prices of goods and services that consumers buy every day. Think of it as a shopping basket filled with everything from groceries to rent. Every month, statisticians update this basket to see how prices have changed. If the basket costs more, inflation is rising. If it costs less, we’re looking at deflation. Simple, right?

Here’s the kicker: CPI doesn’t just measure prices; it tells us how the cost of living is changing. For example, if the price of milk goes up, that’s bad news for your breakfast budget. But if the price of tech gadgets drops, that’s a win for early adopters. CPI gives us a snapshot of these changes, helping us understand how our money’s purchasing power is holding up.

How CPI is Calculated

Now, let’s talk about the nitty-gritty. CPI is calculated using a complex formula that takes into account the prices of thousands of items. These items are grouped into categories like food, housing, transportation, and healthcare. Each category has a weight based on how much people spend on it. For instance, housing usually gets a bigger weight because it’s a significant expense for most folks. By crunching these numbers, statisticians come up with an index number that shows whether prices are going up or down.

Why Does CPI Matter?

Here’s the thing: CPI matters a lot more than you might think. It’s not just some number economists care about; it affects everyone. Let’s say you’re saving for retirement. If inflation rises faster than your savings grow, your money won’t stretch as far in the future. That’s why understanding CPI is crucial for anyone looking to protect their financial future.

On a broader scale, CPI influences monetary policy. Central banks use CPI data to decide whether to raise or lower interest rates. If inflation is too high, they might hike rates to cool things down. If inflation is too low, they might cut rates to stimulate the economy. In short, CPI is the compass that guides economic decision-making.

Impact on Everyday Life

Let’s break it down in terms of everyday life. Imagine you’re at the grocery store, and you notice the price of your favorite cereal has gone up. That’s CPI in action. Or maybe you’re renting an apartment, and your landlord decides to raise the rent. Again, CPI is the culprit. It’s these small changes that add up over time, affecting how much you can afford and how you plan your finances.

Read also:Luke Combs The Journey Of A Modern Country Music Legend

The Role of CPI in Inflation

Now, let’s talk about inflation. CPI is often used as a measure of inflation because it tracks price changes over time. If CPI goes up, it means prices are rising, and inflation is on the rise. If CPI stays flat or goes down, it could signal deflation or a stagnant economy. Inflation isn’t all bad, though. A little bit of inflation is actually good for the economy because it encourages spending and investment.

Core CPI vs. Headline CPI

There’s one more twist to this story: Core CPI and Headline CPI. Headline CPI includes everything in the basket, while Core CPI excludes volatile items like food and energy. Why? Because food and energy prices can swing wildly due to factors like weather or geopolitical events. By focusing on Core CPI, economists get a clearer picture of underlying inflation trends.

How CPI Affects Investments

Investors, listen up. CPI is a game-changer for your portfolio. If inflation is rising, bonds become less attractive because their fixed returns lose value. Stocks, on the other hand, might perform better because companies can pass on higher costs to consumers. But here’s the catch: if inflation gets out of control, it can hurt the stock market too. That’s why savvy investors keep a close eye on CPI data to adjust their strategies.

CPI and Retirement Planning

Retirees, this one’s for you. CPI plays a huge role in retirement planning because it affects how much money you’ll need to live comfortably. Social Security benefits, for example, are adjusted annually based on CPI to help retirees keep up with rising costs. But if inflation outpaces these adjustments, retirees could find themselves struggling to make ends meet.

Global CPI Trends

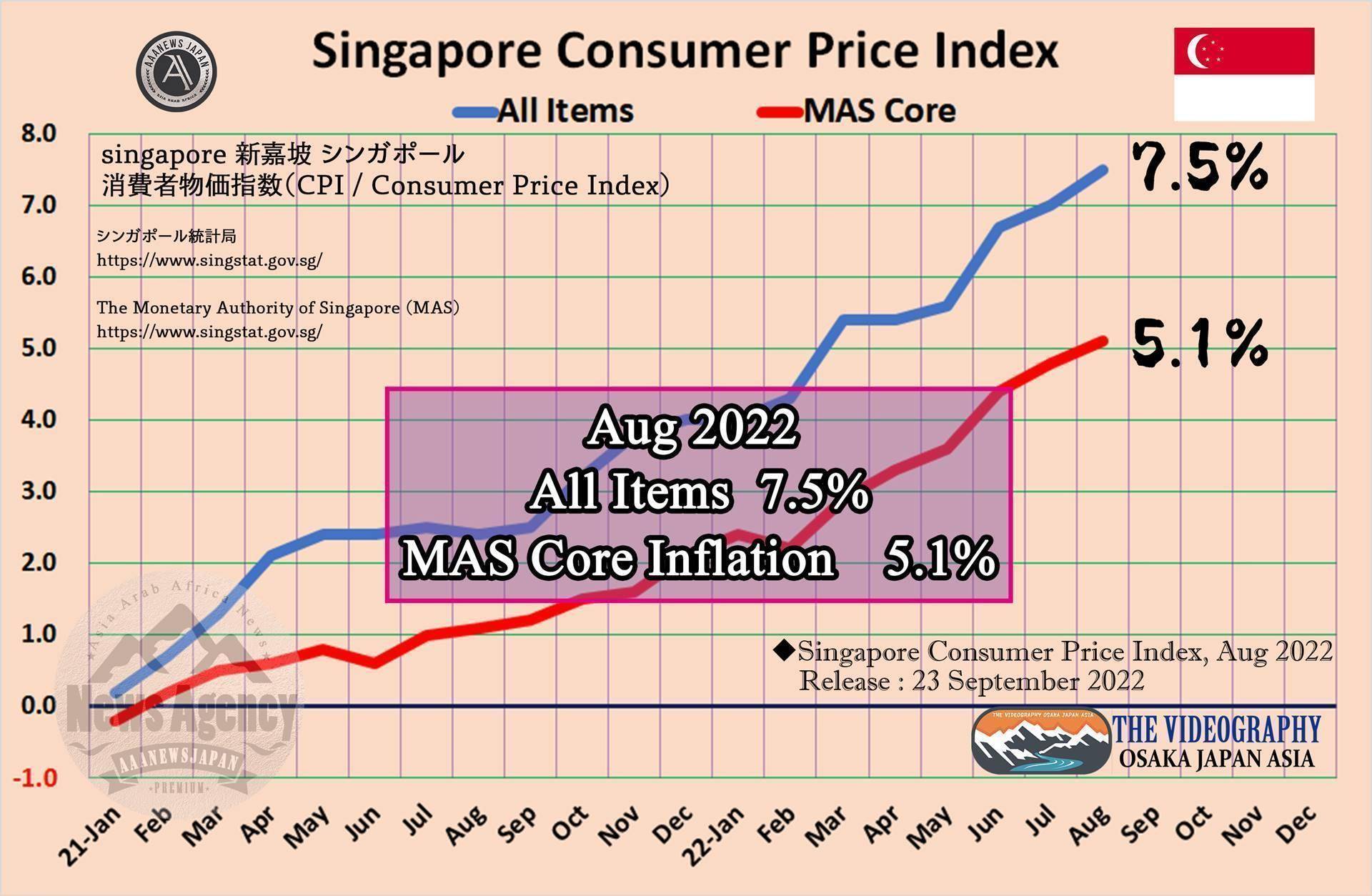

Let’s zoom out for a second and look at the global picture. CPI trends vary from country to country depending on factors like economic policies, population growth, and trade relations. In developing nations, CPI might rise faster due to rapid urbanization and increasing demand for goods. In developed countries, CPI might be more stable, but even small changes can have a big impact on the economy.

Comparing CPI Across Countries

Here’s a fun fact: you can compare CPI across countries to see which ones are experiencing the most inflation. For example, if Country A’s CPI is rising faster than Country B’s, it might mean Country A’s economy is overheating. This kind of data is gold for investors and policymakers looking to make informed decisions.

Challenges in Measuring CPI

Now, let’s talk about the challenges. Measuring CPI isn’t as simple as it sounds. For one, the basket of goods and services used in calculations can change over time. What people buy today might not be the same as what they bought ten years ago. Plus, there’s the issue of quality adjustments. If a product improves, should its price increase count as inflation? These are tricky questions that statisticians have to grapple with.

Substitution Bias

Another challenge is substitution bias. If the price of beef goes up, consumers might switch to chicken instead. But CPI doesn’t always account for these substitutions, which can lead to an overestimation of inflation. It’s like trying to measure the speed of a car while it’s constantly changing gears. Not easy, right?

Future of CPI

Looking ahead, the future of CPI is tied to technological advancements and changing consumer behavior. With the rise of e-commerce and digital payment systems, statisticians have more data than ever to work with. This could lead to more accurate and timely CPI calculations. But with great data comes great responsibility. Ensuring that CPI remains a reliable indicator will require constant innovation and adaptation.

AI and Automation in CPI Calculation

Here’s where things get interesting. AI and automation are already being used to streamline CPI calculations. Algorithms can analyze massive datasets in seconds, spotting trends that humans might miss. This not only speeds up the process but also improves accuracy. But as with any technology, there are risks. Ensuring data privacy and security will be key to maintaining trust in CPI as a reliable economic indicator.

Conclusion

So, there you have it, folks. CPI might seem like a dry topic at first glance, but it’s actually a vital part of our economic landscape. Whether you’re a consumer, investor, or policymaker, understanding CPI can help you make smarter decisions. From tracking inflation to guiding monetary policy, CPI is the unsung hero of the economy. So, the next time you hear someone talking about CPI, you’ll know exactly what they’re talking about.

Now, here’s the call to action. If you found this article helpful, drop a comment below and let us know what you think. Share it with your friends and family so they can get in on the CPI action too. And if you want to dive deeper into the world of economics, check out our other articles. Knowledge is power, and when it comes to CPI, a little knowledge can go a long way.

Table of Contents