So, you've heard about SPY ETF, but you're not sure what it is or how it works? Don't worry; you're not alone. SPY ETF, or SPDR S&P 500 ETF Trust, is one of the most popular exchange-traded funds out there. It's like the rockstar of the investment world, and today, we're diving deep into its world. Whether you're a seasoned investor or just starting out, understanding SPY ETF can be a game-changer for your portfolio.

Imagine having a tool that gives you exposure to 500 of the largest and most influential companies in the U.S. market, all wrapped up in one neat package. That's exactly what SPY ETF offers. But before you jump in, it's crucial to know the ins and outs, the risks, and the rewards. This guide will walk you through everything you need to know about SPY ETF, so buckle up!

Here's the deal: SPY ETF isn't just another financial product. It's a powerhouse that tracks the S&P 500 Index, offering liquidity, diversification, and ease of trading. But like any investment, it comes with its own set of considerations. By the end of this article, you'll have a solid understanding of SPY ETF and how it can fit into your investment strategy.

Read also:Mzee Bomoka Twitter Rock Paper Scissors The Ultimate Guide To The Viral Sensation

What Exactly is SPY ETF?

Let's break it down. SPY ETF, short for SPDR S&P 500 ETF Trust, is an exchange-traded fund that tracks the performance of the S&P 500 Index. Think of it as a basket that holds stocks from 500 leading companies across various industries in the U.S. market. Launched way back in 1993 by State Street Global Advisors, SPY ETF was the first ETF ever created, making it a pioneer in the world of exchange-traded funds.

Why does this matter? Well, SPY ETF gives investors the ability to own a piece of the U.S. economy without having to buy individual stocks. It's like getting a slice of the pie without worrying about picking the right piece. Plus, it's traded like a stock, meaning you can buy and sell it throughout the day, just like you would with any other stock.

Key Features of SPY ETF

Here are some of the standout features of SPY ETF:

- Liquidity: SPY ETF is one of the most liquid ETFs out there, with high trading volumes daily.

- Diversification: By owning SPY ETF, you're effectively diversifying your portfolio across 500 companies.

- Transparency: The holdings of SPY ETF are disclosed daily, giving investors a clear picture of what they own.

- Cost-Effective: With a low expense ratio, SPY ETF offers an affordable way to gain exposure to the S&P 500.

Why Should You Invest in SPY ETF?

Alright, so why should you consider adding SPY ETF to your portfolio? There are several compelling reasons:

First off, SPY ETF provides broad market exposure. Instead of betting on a single stock, you're investing in the overall health of the U.S. economy. This reduces the risk associated with individual stock picking. Plus, the S&P 500 has historically delivered strong returns over the long term, making SPY ETF an attractive option for both short-term traders and long-term investors.

Additionally, SPY ETF offers flexibility. You can trade it like a stock, using strategies such as stop-loss orders, limit orders, and even options. This makes it a versatile tool for different types of investors.

Read also:What Does Inri On The Cross Really Mean Unveiling The Hidden Significance

Who Should Invest in SPY ETF?

SPY ETF is suitable for a wide range of investors, including:

- Beginners: If you're new to investing, SPY ETF is a great way to get started without taking on too much risk.

- Long-Term Investors: Those looking to build wealth over time can benefit from the historical growth of the S&P 500.

- Active Traders: With its high liquidity, SPY ETF is perfect for traders who want to make quick moves based on market conditions.

Understanding the Risks of SPY ETF

Now, let's talk about the risks. While SPY ETF offers numerous benefits, it's not without its downsides. The value of SPY ETF is directly tied to the performance of the S&P 500 Index. This means that if the market takes a hit, so does your investment.

Moreover, while diversification reduces risk, it doesn't eliminate it entirely. Economic downturns, geopolitical events, and other factors can still impact the performance of the S&P 500, and by extension, SPY ETF.

How to Mitigate Risks with SPY ETF

Here are some strategies to help mitigate the risks:

- Dollar-Cost Averaging: Invest a fixed amount regularly to smooth out market volatility.

- Asset Allocation: Don't put all your eggs in one basket. Diversify your portfolio with other asset classes.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses if the market moves against you.

How Does SPY ETF Compare to Other ETFs?

When it comes to ETFs that track the S&P 500, SPY ETF has some serious competition. Two of its main rivals are the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO). So, how does SPY ETF stack up?

While all three ETFs track the same index, they differ in terms of expense ratios, trading volumes, and options availability. SPY ETF has the highest expense ratio among the three but offers the highest trading volume and the most liquid options market. This makes it a favorite among active traders.

Expense Ratios Comparison

Here's a quick comparison of the expense ratios:

- SPY ETF: 0.0945%

- IVV ETF: 0.03%

- VOO ETF: 0.03%

How to Trade SPY ETF

Trading SPY ETF is relatively straightforward. You can buy and sell it through any brokerage account, just like you would with a regular stock. However, there are a few things to keep in mind:

First, consider the trading costs. While SPY ETF itself has a low expense ratio, you may incur brokerage fees when buying and selling. Additionally, if you're planning to use options, make sure your brokerage account supports this feature.

Strategies for Trading SPY ETF

Here are some popular strategies for trading SPY ETF:

- Buy and Hold: Ideal for long-term investors who want to benefit from the historical growth of the S&P 500.

- Swing Trading: Suitable for those who want to take advantage of short-term price movements.

- Options Trading: Advanced traders can use options to hedge risk or generate income.

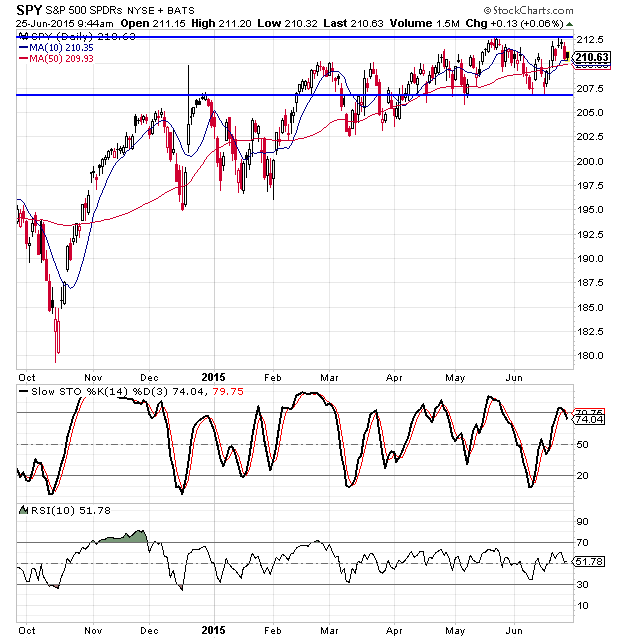

Historical Performance of SPY ETF

Let's take a look at the historical performance of SPY ETF. Since its inception in 1993, SPY ETF has delivered impressive returns, closely tracking the S&P 500 Index. While past performance is not indicative of future results, it does provide some insight into what investors can expect.

For example, over the past decade, SPY ETF has seen an average annual return of around 10%. Of course, there have been ups and downs along the way, but the overall trend has been upward.

Factors Affecting SPY ETF Performance

Several factors can affect the performance of SPY ETF, including:

- Economic Indicators: GDP growth, employment rates, and inflation can all impact the S&P 500.

- Federal Reserve Policies: Interest rate changes and monetary policies can influence market sentiment.

- Global Events: Geopolitical tensions, trade wars, and other global events can affect market performance.

SPY ETF in the Modern Investment Landscape

In today's fast-paced investment landscape, SPY ETF remains a cornerstone for many portfolios. Its combination of liquidity, diversification, and ease of trading makes it an attractive option for a wide range of investors.

Moreover, with the rise of robo-advisors and automated investment platforms, SPY ETF is often included in pre-built portfolios, further increasing its popularity.

Future Outlook for SPY ETF

Looking ahead, the future for SPY ETF seems bright. As more investors embrace ETFs as a preferred investment vehicle, SPY ETF is likely to continue its dominance in the market. However, it's always important to stay informed and adapt to changing market conditions.

Conclusion: Is SPY ETF Right for You?

So, is SPY ETF the right investment for you? That depends on your investment goals, risk tolerance, and time horizon. For those seeking broad market exposure, diversification, and flexibility, SPY ETF is definitely worth considering.

Remember, investing always comes with risks, and it's crucial to do your research and consult with a financial advisor if needed. But with its long history of success and strong track record, SPY ETF remains a top choice for many investors.

Now it's your turn. Have you invested in SPY ETF? What's been your experience? Leave a comment below and let's keep the conversation going. And don't forget to share this article with your fellow investors who might find it helpful!

Table of Contents: