Let’s dive into something that’s been buzzing around Wall Street and the financial world like a swarm of bees – the VIX. Yeah, you’ve probably heard about it. The Volatility Index, or as some call it, the "fear gauge," is often used to predict market movements. But here’s the thing – is it really as reliable as people think? Or does it come with a set of limitations that we need to be aware of?

Imagine this: you’re sitting in your cozy home office, scrolling through financial news, and you see headlines about the VIX spiking. Your heart races. Is it time to sell everything? Or is it just a false alarm? The truth is, the VIX can be a powerful tool, but it’s not without its flaws. Understanding these limitations can help you make smarter investment decisions.

In this article, we’ll break down what the VIX is, how it works, and most importantly, its limitations. Whether you’re a seasoned investor or just starting out, knowing the ins and outs of the VIX can give you an edge in the market. So, grab your favorite drink, and let’s get started.

Read also:Doona Vs Evenflo The Ultimate Showdown In Portable Car Seats

Daftar Isi

Read also:How To See Other Viewers On Facebook Story Iphone The Ultimate Guide

What is the VIX?

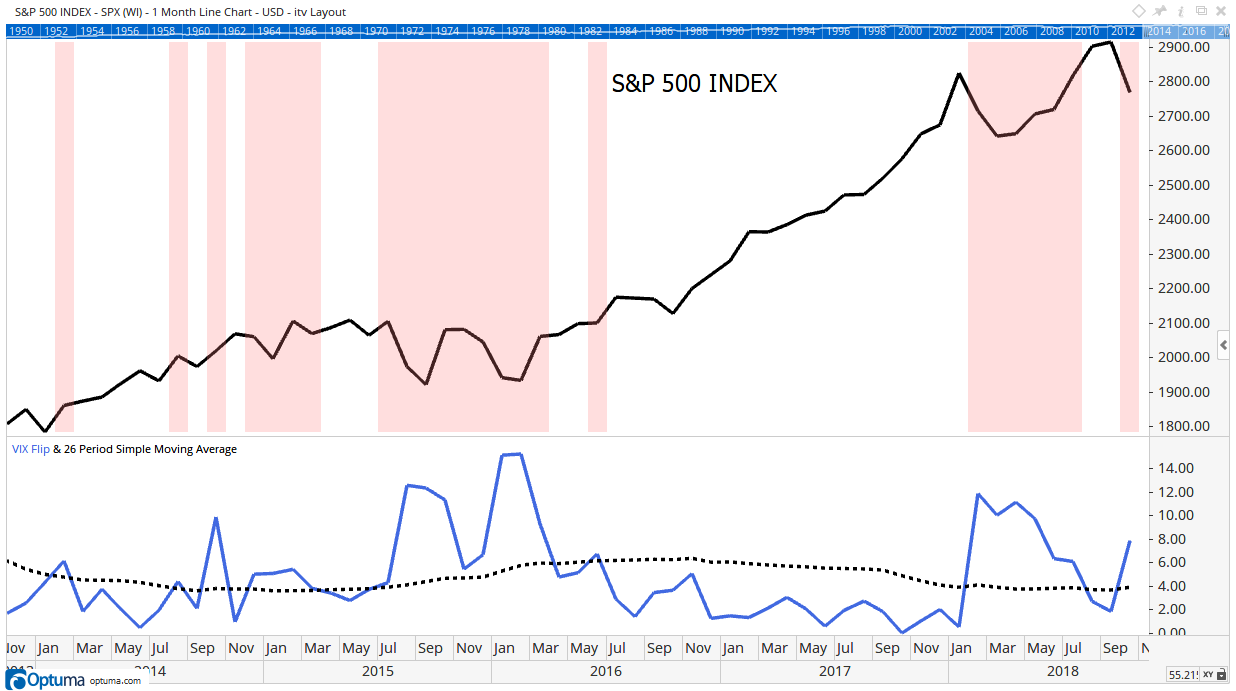

The VIX, or Volatility Index, is a key financial metric that measures the expected volatility of the S&P 500 index over the next 30 days. It’s calculated using options prices, and it essentially tells us how much uncertainty or risk is priced into the market. Think of it as a thermometer for investor fear. But here’s the kicker – it doesn’t predict direction. It just tells us how much the market is expected to move, up or down.

Now, the VIX isn’t just any number. It’s been around since 1993, and over the years, it’s become a go-to tool for investors looking to gauge market sentiment. But like any tool, it has its strengths and weaknesses. And understanding those weaknesses is crucial if you want to use the VIX effectively.

How Does the VIX Work?

Alright, let’s break it down. The VIX is based on the prices of options contracts for the S&P 500 index. These options reflect what investors think will happen to the market in the near future. When the VIX is high, it means investors are expecting a lot of volatility – aka big price swings. When it’s low, it means things are expected to be pretty calm.

But here’s where things get interesting. The VIX doesn’t just measure historical volatility – it measures implied volatility. That means it’s based on expectations, not what’s already happened. And like any prediction, it’s not always 100% accurate. Sometimes the market doesn’t behave the way the VIX predicts it will.

Why Is the VIX Important?

For investors, the VIX is like a weather forecast. It gives you an idea of what to expect in the short term. High VIX readings can signal market stress, while low readings can indicate complacency. But here’s the thing – the VIX isn’t a crystal ball. It can’t tell you exactly when a market crash will happen or how long a bull market will last. It’s more of a guide than a guarantee.

VIX as a Market Indicator

So, why do people use the VIX as a market indicator? Well, it’s because it gives us a snapshot of market sentiment. When the VIX spikes, it often means investors are nervous. And when it dips, it can mean they’re feeling pretty confident. But here’s the catch – the VIX isn’t always a reliable predictor of market direction. Just because the VIX is high doesn’t mean the market is going to crash. And just because it’s low doesn’t mean everything is peachy.

Think of it like this: the VIX is like a smoke detector. It can tell you when there’s smoke, but it can’t tell you where the fire is or how big it is. That’s why it’s important to use the VIX in conjunction with other indicators and tools.

What Does the VIX Tell Us?

The VIX can give us valuable insights into market behavior. For example, when the VIX is high, it might be a good time to consider hedging strategies. And when it’s low, it might be a good time to take on more risk. But again, it’s not a foolproof system. The VIX can sometimes give false signals, so it’s important to use it as part of a broader investment strategy.

Limitations of the VIX

Now, let’s talk about the elephant in the room – the limitations of the VIX. While it’s a useful tool, it’s not without its flaws. Here are some of the key limitations you need to be aware of:

- Short-Term Focus: The VIX only looks at the next 30 days. That means it’s not great for long-term forecasting.

- Implied Volatility: The VIX is based on expectations, not reality. Sometimes the market doesn’t behave the way investors expect it to.

- No Directional Indication: The VIX doesn’t tell you whether the market is going up or down. It just tells you how much it’s expected to move.

- Market Sentiment Bias: The VIX can be influenced by extreme market conditions, which can lead to false signals.

Why Are These Limitations Important?

Understanding the limitations of the VIX can help you avoid making costly mistakes. For example, if you rely too heavily on the VIX to predict market movements, you might end up making decisions based on incomplete or inaccurate information. That’s why it’s important to use the VIX as part of a broader investment strategy.

Short-Term Predictions

One of the biggest limitations of the VIX is its focus on short-term predictions. While it can give you a good idea of what to expect in the next 30 days, it’s not great for long-term forecasting. That’s because the market is influenced by a wide range of factors, many of which aren’t captured by the VIX.

For example, geopolitical events, economic data, and company earnings can all have a big impact on the market. And the VIX doesn’t take these factors into account. So, while it can give you a snapshot of current market sentiment, it’s not a crystal ball for predicting long-term trends.

How Can You Use the VIX for Short-Term Trading?

Despite its limitations, the VIX can still be a useful tool for short-term traders. By monitoring VIX levels, you can get a sense of market sentiment and adjust your trading strategy accordingly. For example, if the VIX is high, you might want to consider hedging strategies to protect against potential market downturns. And if it’s low, you might want to take on more risk.

Long-Term Forecasting

When it comes to long-term forecasting, the VIX falls short. That’s because it only looks at the next 30 days, and the market is influenced by a wide range of factors that can’t be captured by a single metric. For example, economic trends, interest rates, and global events can all have a big impact on the market over the long term.

So, if you’re looking to make long-term investment decisions, you’ll need to look beyond the VIX. Consider using other tools and indicators, such as fundamental analysis, technical analysis, and economic data, to get a more complete picture of the market.

What Other Tools Can You Use?

Here are some other tools you can use for long-term forecasting:

- Fundamental Analysis: This involves analyzing a company’s financial statements, management team, and competitive position.

- Technical Analysis: This involves analyzing price charts and trading patterns to predict future price movements.

- Economic Indicators: These include data such as GDP growth, inflation rates, and employment figures.

Market Extremes

Another limitation of the VIX is its tendency to give false signals during market extremes. For example, during a market crash, the VIX might spike to unprecedented levels, leading investors to believe that the worst is yet to come. But sometimes, the market recovers quickly, and the VIX ends up being a false alarm.

Similarly, during a bull market, the VIX might stay low for extended periods, leading investors to believe that everything is fine. But sometimes, the market can suddenly turn, catching investors off guard.

How Can You Avoid False Signals?

To avoid false signals, it’s important to use the VIX in conjunction with other indicators and tools. For example, you might want to look at economic data, company earnings, and geopolitical events to get a more complete picture of the market. By combining multiple sources of information, you can make more informed investment decisions.

External Factors

The VIX can also be influenced by external factors that aren’t directly related to market conditions. For example, geopolitical events, natural disasters, and unexpected news can all cause the VIX to spike, even if the underlying fundamentals of the market haven’t changed.

That’s why it’s important to be aware of these external factors and how they might impact the VIX. By keeping an eye on global events and news, you can better understand the context behind VIX movements and make more informed investment decisions.

What External Factors Should You Watch Out For?

Here are some external factors that can impact the VIX:

- Geopolitical Events: Wars, trade disputes, and political instability can all cause market volatility.

- Natural Disasters: Hurricanes, earthquakes, and other natural disasters can disrupt supply chains and impact the economy.

- Unexpected News: Unexpected announcements, such as earnings surprises or regulatory changes, can also cause market volatility.

Data Reliability

Finally, it’s important to consider the reliability of the data used to calculate the VIX. While the VIX is based on options prices, these prices can sometimes be influenced by market manipulation or other factors that don’t reflect true market conditions. That’s why it’s important to use the VIX as part of a broader investment strategy and not rely on it as the sole source of information.

How Can You Ensure Data Reliability?

To ensure data reliability, it’s important to use multiple sources of information and verify the data before making investment decisions. For example, you might want to look at data from multiple exchanges or use third-party verification services to confirm the accuracy of the data.

Conclusion

So, there you have it – the limitations of using the VIX as a market indicator. While the VIX can be a powerful tool, it’s not without its flaws. Its short-term focus, reliance on implied volatility, and susceptibility to external factors all mean that it shouldn’t be used as the sole basis for investment decisions.

Instead, use the VIX as part of a broader investment strategy that incorporates other tools and indicators. By doing so, you can make more informed decisions and avoid falling into the trap of relying too heavily on one metric.

And remember, the financial markets are unpredictable. No single tool or indicator can give you all the answers. So, stay informed, stay flexible, and most importantly, stay smart. Your wallet will thank you for it!

Now, it’s your turn. What do you think about the VIX? Have you used it in your investment strategy? Let us know in the comments below. And don’t forget to share this article with your friends and colleagues who might find it useful. Happy investing!