Inflation is one of the most critical economic indicators that impacts everyone's daily life. Whether you're an investor, a business owner, or just someone trying to make ends meet, staying informed about the latest inflation trends is essential. Inflation affects purchasing power, savings, investments, and overall economic stability. This article will delve deep into the latest inflation trends, exploring their causes, effects, and strategies to manage them effectively.

As global economies continue to evolve, understanding inflation becomes even more crucial. The latest inflation trends highlight shifts in economic policies, supply chain disruptions, and other macroeconomic factors. By staying informed, individuals and businesses can better prepare for potential financial challenges.

This guide aims to provide a comprehensive overview of the latest inflation trends, offering actionable insights and expert advice. Whether you're looking to protect your savings or grow your investments, this article will equip you with the knowledge needed to navigate the current economic landscape.

Read also:Paul Wesley Eye Color A Deeper Dive Into Those Mesmerizing Eyes

Table of Contents

- Introduction to Inflation

- Causes of the Latest Inflation

- Effects of Inflation on the Economy

- How Inflation Is Measured

- Historical Context of Inflation

- Global Inflation Trends

- Strategies to Combat Inflation

- Investment Opportunities Amidst Inflation

- Future Outlook for Inflation

- Conclusion and Call to Action

Introduction to Inflation

Inflation refers to the general increase in prices of goods and services over time, leading to a decrease in purchasing power. The latest inflation trends are influenced by various factors, including monetary policies, supply and demand dynamics, and global economic conditions. Understanding these trends is vital for making informed financial decisions.

Inflation impacts different sectors of the economy in unique ways. For instance, rising prices can lead to increased costs for businesses, affecting profitability. At the same time, consumers may face challenges in maintaining their standard of living as prices for essential goods and services rise.

Key Drivers of Inflation

- Monetary Policy: Central banks play a significant role in controlling inflation through interest rate adjustments and quantitative easing.

- Supply Chain Disruptions: Global events such as pandemics or geopolitical conflicts can disrupt supply chains, leading to higher costs.

- Energy Prices: Fluctuations in oil and gas prices significantly influence inflation rates.

Causes of the Latest Inflation

The latest inflation trends are driven by a combination of factors, including post-pandemic economic recovery, geopolitical tensions, and shifts in consumer behavior. As economies reopen, pent-up demand has led to increased consumption, putting upward pressure on prices.

Post-Pandemic Recovery

After the global pandemic, many countries implemented stimulus packages to boost economic growth. While these measures were effective in driving recovery, they also contributed to inflationary pressures. Increased government spending and lower interest rates encouraged borrowing and spending, leading to higher demand for goods and services.

Effects of Inflation on the Economy

Inflation has far-reaching effects on the economy, influencing various stakeholders. For consumers, inflation erodes purchasing power, making it harder to afford basic necessities. Businesses may face higher production costs, impacting profitability and competitiveness. Additionally, inflation can affect savings and investments, altering financial planning for individuals and institutions.

Impact on Different Sectors

- Consumer Goods: Rising prices for everyday items can strain household budgets.

- Real Estate: Inflation often leads to increased property values, affecting both buyers and renters.

- Financial Markets: Inflation impacts stock and bond prices, influencing investment strategies.

How Inflation Is Measured

Inflation is typically measured using indices such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). These indices track changes in the prices of a basket of goods and services over time, providing insights into inflationary trends. Economists and policymakers use these metrics to assess the health of the economy and make informed decisions.

Read also:Victor Oladipo Missing The Untold Story You Need To Know

Limitations of Inflation Measures

While CPI and PPI are widely used, they have limitations. For instance, these indices may not fully capture the impact of quality changes or new product introductions. Additionally, regional variations in inflation rates can affect the accuracy of national averages.

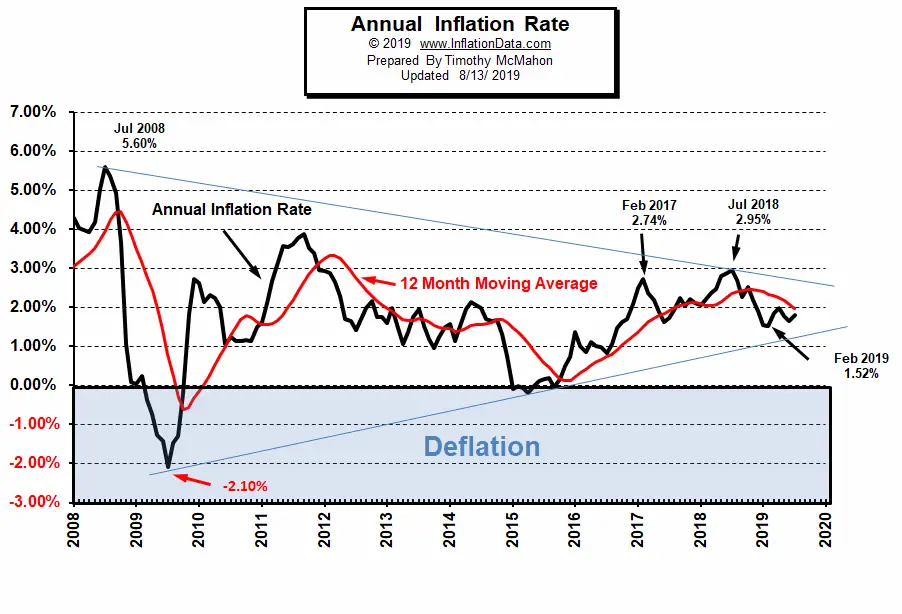

Historical Context of Inflation

Inflation has been a recurring theme throughout history, with notable periods such as the Great Inflation of the 1970s and the hyperinflation experienced by some countries. Understanding these historical contexts provides valuable lessons for addressing current inflationary pressures.

Lessons from the Past

- The 1970s Oil Crisis: Highlighted the importance of energy independence and diversification.

- Hyperinflation in Zimbabwe: Demonstrated the dangers of excessive money printing.

Global Inflation Trends

Global inflation trends vary across regions, influenced by local economic conditions and policies. Developed economies like the United States and European Union have experienced moderate inflation, while emerging markets face more significant challenges due to currency fluctuations and political instability.

Regional Variations

- Asia: Rapid economic growth has led to higher inflation in some countries.

- Europe: Energy dependence on external sources has exacerbated inflationary pressures.

Strategies to Combat Inflation

To mitigate the effects of inflation, individuals and businesses can adopt various strategies. These include diversifying investments, hedging against currency risks, and optimizing operational efficiencies. Governments also play a crucial role in managing inflation through fiscal and monetary policies.

Personal Strategies

- Invest in Inflation-Protected Assets: Consider assets like gold or real estate that tend to perform well during inflationary periods.

- Adjust Spending Habits: Prioritize essential expenses and seek discounts or alternatives for non-essential items.

Investment Opportunities Amidst Inflation

Despite the challenges posed by inflation, there are investment opportunities that can yield positive returns. Sectors such as technology, healthcare, and renewable energy continue to attract significant interest. Additionally, commodities like oil and precious metals often benefit from inflationary environments.

Sectors to Watch

- Technology: Innovations in artificial intelligence and automation offer growth potential.

- Renewable Energy: Transition to sustainable energy sources creates new investment avenues.

Future Outlook for Inflation

The future outlook for inflation depends on several factors, including global economic conditions, policy decisions, and technological advancements. While short-term inflationary pressures may persist, long-term trends suggest a gradual stabilization as economies adjust to new realities.

Predictions and Forecasts

According to the International Monetary Fund (IMF), global inflation is expected to moderate in the coming years as supply chain issues resolve and demand stabilizes. However, ongoing geopolitical tensions and climate change could introduce new challenges.

Conclusion and Call to Action

In conclusion, understanding the latest inflation trends is crucial for navigating the complexities of the modern economy. By staying informed and adopting appropriate strategies, individuals and businesses can effectively manage the challenges posed by inflation. We encourage readers to share their thoughts and experiences in the comments section below. Additionally, explore other articles on our site for more insights into economic trends and investment opportunities.

Stay updated, make informed decisions, and secure your financial future. Together, we can navigate the ever-changing economic landscape and achieve long-term success.