Inflation is one of the most critical factors that shape the global economy, and understanding its implications for the year 2025 is essential for both individuals and businesses. As we approach this milestone year, economic experts predict significant shifts in inflation rates worldwide. These changes will impact purchasing power, investment opportunities, and overall economic stability. In this article, we will explore what inflation 2025 entails and how it may affect various sectors of the economy.

By examining historical trends, expert forecasts, and potential triggers for inflation, we aim to provide a clear and actionable roadmap for navigating the economic landscape of 2025. Whether you're an investor, a business owner, or simply someone looking to secure your financial future, this guide will equip you with the knowledge you need to prepare for what lies ahead.

Stay tuned as we delve into the complexities of inflation, offering insights into how you can mitigate risks and capitalize on opportunities in the coming years. Understanding inflation 2025 isn't just about numbers—it's about securing your financial well-being in an ever-evolving world.

Read also:Ahora Que Paso Meme The Ultimate Guide To The Viral Sensation

Table of Contents

- What is Inflation?

- Historical Trends of Inflation

- Inflation Forecast for 2025

- Factors Affecting Inflation in 2025

- Economic Impact of Inflation 2025

- Investment Strategies for Inflation 2025

- Government Policies and Inflation Control

- Global Perspective on Inflation 2025

- How Individuals Can Prepare for Inflation 2025

- Conclusion: Navigating the Future of Inflation

What is Inflation?

Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. When inflation occurs, each unit of currency buys fewer goods and services, leading to a decrease in purchasing power. This economic phenomenon is measured using indices such as the Consumer Price Index (CPI) and the Producer Price Index (PPI).

Inflation is a natural part of a growing economy, but excessive or unpredictable inflation can lead to economic instability. Understanding the mechanisms behind inflation is crucial for anticipating its effects and developing strategies to counteract negative impacts.

For inflation 2025, experts predict a combination of factors that could drive inflation rates higher than average, including monetary policies, global supply chain disruptions, and technological advancements.

Historical Trends of Inflation

Post-War Inflation

Throughout history, inflation has fluctuated significantly, influenced by wars, economic policies, and technological changes. For example, post-World War II inflation was driven by increased government spending and reconstruction efforts. Similarly, the 1970s oil crisis led to a surge in inflation due to energy price spikes.

Modern-Day Inflation

In recent decades, inflation has been relatively stable in many developed countries, thanks to central bank interventions and globalization. However, the 2008 financial crisis demonstrated how quickly inflation can spiral out of control if not properly managed.

Looking ahead to inflation 2025, historical patterns suggest that periods of rapid economic growth or recovery often coincide with rising inflation rates. This trend is particularly relevant as economies recover from the disruptions caused by the global pandemic.

Read also:Upgrade Your Living Room With A Stylish Maili Sectional Sofa

Inflation Forecast for 2025

Experts predict that inflation rates in 2025 will be influenced by several key factors, including central bank policies, technological advancements, and demographic shifts. While some regions may experience moderate inflation, others could face more significant challenges.

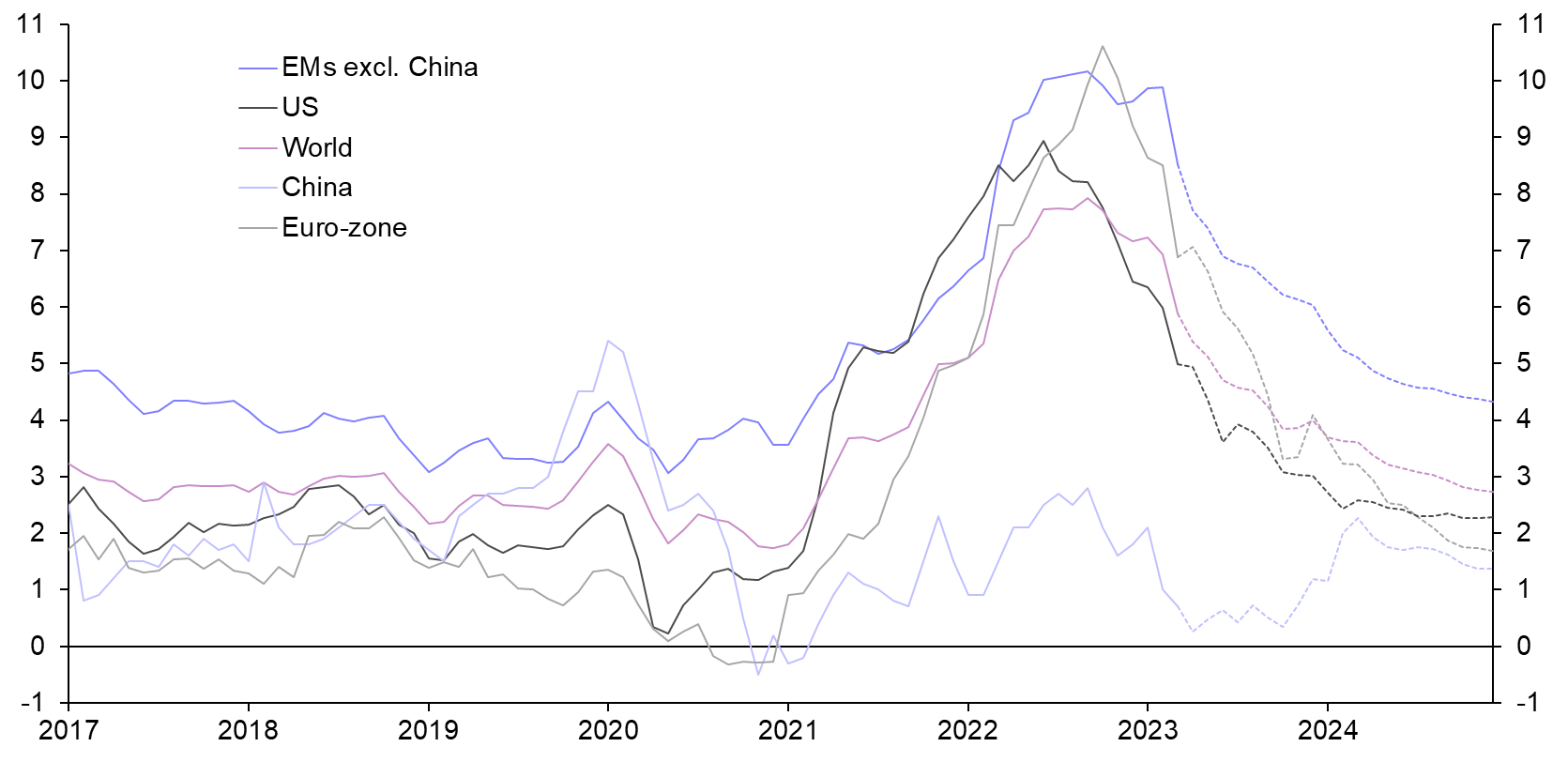

According to the International Monetary Fund (IMF), inflation in developed economies is expected to remain below 3%, while emerging markets may see rates closer to 5%. However, these projections are subject to change based on unforeseen global events.

For individuals and businesses, understanding these forecasts is vital for planning and decision-making. Inflation 2025 will likely require proactive measures to protect assets and maintain financial stability.

Factors Affecting Inflation in 2025

Monetary Policies

Central banks play a critical role in managing inflation through monetary policies such as interest rate adjustments and quantitative easing. As economies recover from the pandemic, many central banks have adopted expansionary policies to stimulate growth, which could lead to higher inflation in 2025.

Supply Chain Disruptions

The ongoing global supply chain challenges have already contributed to rising prices in various sectors. If these disruptions persist, they could further exacerbate inflation 2025, particularly in industries reliant on imported goods and raw materials.

Technological Advancements

While technology has traditionally contributed to deflationary pressures through increased efficiency and productivity, some experts argue that emerging technologies could drive inflation in 2025. For example, increased demand for advanced technologies and digital infrastructure could lead to higher costs for consumers and businesses alike.

Economic Impact of Inflation 2025

The economic impact of inflation 2025 will be felt across various sectors, affecting everything from consumer spending to international trade. Rising prices could lead to reduced purchasing power for households, forcing consumers to prioritize essential goods and services over discretionary spending.

Businesses may also face challenges as input costs rise, potentially leading to reduced profit margins or increased prices for consumers. Additionally, inflation could impact financial markets, as investors adjust their portfolios to account for changing economic conditions.

On a global scale, inflation 2025 could influence currency exchange rates and trade balances, further complicating international economic relations.

Investment Strategies for Inflation 2025

Asset Allocation

One of the most effective ways to protect against inflation is through strategic asset allocation. Investors should consider diversifying their portfolios to include assets such as stocks, real estate, and commodities, which tend to perform well during inflationary periods.

Hedging Against Inflation

Inflation-indexed bonds and Treasury Inflation-Protected Securities (TIPS) are popular tools for hedging against inflation. These instruments provide a safeguard against rising prices by adjusting principal values based on inflation rates.

Long-Term Planning

For long-term investors, focusing on companies with strong pricing power and robust business models can help mitigate the effects of inflation. Additionally, investing in sectors that benefit from inflation, such as energy and materials, may offer opportunities for growth.

Government Policies and Inflation Control

Governments and central banks have a range of tools at their disposal to manage inflation, including fiscal and monetary policies. In 2025, policymakers may need to balance the need for economic growth with the risks of excessive inflation.

Fiscal policies, such as tax adjustments and government spending, can influence inflation by affecting aggregate demand. Meanwhile, monetary policies, including interest rate changes and reserve requirements, provide central banks with mechanisms to control money supply and stabilize prices.

As inflation 2025 approaches, governments will need to remain vigilant in monitoring economic indicators and adjusting policies as necessary to ensure stability.

Global Perspective on Inflation 2025

Developed Economies

In developed economies, inflation 2025 is expected to remain relatively moderate, thanks to well-established monetary policies and robust financial systems. However, challenges such as aging populations and rising healthcare costs could contribute to upward pressure on prices.

Emerging Markets

Emerging markets may face more significant inflationary pressures due to weaker currencies, higher debt levels, and greater reliance on imported goods. These economies will need to carefully manage inflation to avoid destabilizing effects on growth and development.

Global cooperation and coordination among central banks and governments will be essential in addressing inflation 2025 and ensuring a stable economic environment for all nations.

How Individuals Can Prepare for Inflation 2025

For individuals, preparing for inflation 2025 involves a combination of financial planning and lifestyle adjustments. Building a diversified investment portfolio, increasing savings, and reducing debt are all effective strategies for mitigating the effects of inflation.

- Invest in inflation-resistant assets such as real estate, commodities, and stocks.

- Consider fixed-income investments like inflation-indexed bonds.

- Reduce discretionary spending and prioritize essential expenses.

- Explore alternative income streams to offset rising costs.

By taking proactive steps today, individuals can better prepare for the economic challenges of inflation 2025 and safeguard their financial futures.

Conclusion: Navigating the Future of Inflation

Inflation 2025 represents a critical juncture in the global economy, with significant implications for individuals, businesses, and governments alike. By understanding the factors driving inflation and developing strategies to address its effects, we can navigate this period of economic uncertainty with confidence.

We encourage you to take action today by reviewing your financial plans, diversifying your investments, and staying informed about economic developments. Share your thoughts and questions in the comments below, and don't hesitate to explore other articles on our site for additional insights into personal finance and economic trends.

Remember, preparation is key to thriving in an inflationary environment. Together, we can build a brighter financial future for ourselves and future generations.