The Volatility Index, commonly referred to as VIX, plays a pivotal role in shaping modern financial markets. It acts as a critical indicator of market sentiment and investor expectations regarding future volatility. For traders, investors, and analysts aiming to navigate the complexities of financial markets effectively, comprehending VIX is essential.

Financial markets are inherently unpredictable, and managing risk is a fundamental challenge for all market participants. The Volatility Index provides invaluable insights into the level of uncertainty and fear in the market, making it an indispensable tool for informed decision-making.

This in-depth guide will delve into the concept of VIX, its importance, and how it influences financial markets. By the conclusion of this article, you will possess a profound understanding of how to utilize VIX in your investment strategies effectively.

Read also:John Paul Tremblay The Iconic Creator Who Redefined Comedy

Below is a detailed table of contents designed to guide you through the article:

Table of Contents

- What is the Volatility Index (VIX)?

- The Evolution of the Volatility Index

- How Does the Volatility Index Operate?

- Exploring Types of Volatility

- VIX and Market Sentiment Analysis

- Leveraging VIX for Risk Management

- Strategies for Trading VIX

- The Relationship Between VIX and the Stock Market

- Analyzing VIX Data and Statistics

- Final Thoughts

What is the Volatility Index (VIX)?

The Volatility Index, often referred to as VIX, is a real-time market index that represents the market's expectation of 30-day forward-looking volatility. Developed by the Chicago Board Options Exchange (CBOE), VIX is derived from the price inputs of S&P 500 index options. It serves as a critical barometer for measuring investor sentiment and market volatility, offering valuable insights into the financial landscape.

Key Characteristics of VIX

- VIX is frequently called the "fear gauge" due to its reflection of the level of fear or complacency in the market.

- Calculated using a sophisticated formula that considers the implied volatility of S&P 500 options, ensuring accuracy and relevance.

- VIX values exceeding 30 typically indicate high volatility and fear, while values below 20 suggest low volatility and complacency, providing traders with actionable insights.

The Evolution of the Volatility Index

The Volatility Index was first introduced by the CBOE in 1993. Initially based on the S&P 100 index options, it transitioned in 2003 to the broader S&P 500 index options, enhancing its precision and relevance in reflecting market conditions. Over the years, VIX has become a globally recognized benchmark for market volatility, widely accepted and utilized by financial professionals.

Advancements in VIX

VIX has undergone significant evolution since its inception, with advancements in technology and financial modeling improving its calculation methods. Today, VIX is accessible in various forms, including futures and exchange-traded products (ETPs), enabling investors to trade volatility directly and effectively incorporate it into their strategies.

How Does the Volatility Index Operate?

VIX functions by analyzing the prices of S&P 500 index options to estimate expected future volatility. The calculation involves a weighted average of the prices of options with varying strike prices and expiration dates. This comprehensive approach ensures that VIX provides a holistic view of market expectations, offering traders and investors a reliable gauge of future market movements.

Components of VIX Calculation

- S&P 500 index options with near-term and next-term expirations, providing a balanced perspective on market expectations.

- Implied volatility derived from the prices of these options, reflecting the market's forecasted volatility.

- A sophisticated weighting mechanism to account for different strike prices and maturities, ensuring accuracy and relevance.

Exploring Types of Volatility

Volatility can be categorized into two primary types: historical volatility and implied volatility. Understanding these distinctions is crucial for accurately interpreting VIX data and leveraging it effectively in investment strategies.

Read also:Exploring The Hilarious World Of Fatherhood Through Bert Kreischers Lens

Historical Volatility vs. Implied Volatility

- Historical Volatility: Measures the actual price fluctuations of an asset over a defined period, offering insight into past market behavior.

- Implied Volatility: Reflects the market's expectation of future volatility based on option prices, providing traders with a forward-looking perspective on potential market movements.

VIX and Market Sentiment Analysis

VIX is a powerful tool for gauging market sentiment. An increase in VIX often signals heightened fear and uncertainty among investors, while a declining VIX suggests growing confidence and complacency in the market. By monitoring VIX levels, traders and analysts can gain valuable insights into market dynamics and make informed decisions.

Factors Influencing VIX Levels

- Economic indicators such as GDP growth, inflation rates, and employment data significantly impact VIX levels, reflecting broader economic conditions.

- Geopolitical events, including elections, trade tensions, and conflicts, contribute to fluctuations in VIX, highlighting the interconnectedness of global markets.

- Central bank policies and interest rate decisions play a crucial role in shaping VIX levels, influencing market expectations and investor behavior.

Leveraging VIX for Risk Management

Investors and traders utilize VIX as a risk management tool to hedge against market volatility. By integrating VIX into their investment strategies, they can better protect their portfolios against adverse market conditions, ensuring long-term stability and growth.

Strategies for Managing Risk with VIX

- Purchasing VIX futures or options to hedge against potential market downturns, providing a safety net for investment portfolios.

- Utilizing VIX-based ETPs to gain exposure to volatility without directly trading options, offering a convenient and accessible option for risk management.

- Implementing diversification strategies to mitigate risk across asset classes, enhancing portfolio resilience and performance.

Strategies for Trading VIX

VIX presents numerous opportunities for traders to profit from volatility fluctuations. However, trading VIX requires a thorough understanding of its mechanics and the associated risks. By employing effective strategies, traders can maximize their potential for success in the dynamic world of financial markets.

Popular VIX Trading Strategies

- Buy and Hold: Holding VIX futures or ETPs during periods of high volatility to capitalize on market uncertainty and potential gains.

- Spread Trading: Simultaneously buying and selling VIX options with varying strike prices or expirations to capitalize on price differentials and market inefficiencies.

- Arbitrage: Exploiting price discrepancies between VIX futures and options to generate profits through strategic trades and market insights.

The Relationship Between VIX and the Stock Market

VIX exhibits an inverse relationship with the stock market. As stock prices rise, VIX tends to decline, and conversely, when stock prices fall, VIX increases. This inverse correlation makes VIX a valuable indicator for predicting market reversals and anticipating shifts in market sentiment.

Impact of VIX on Stock Market Performance

High VIX levels often precede market corrections or crashes, serving as a warning signal for investors. Conversely, low VIX levels may indicate a bullish market trend, suggesting potential opportunities for growth and expansion. Traders and analysts closely monitor VIX to anticipate potential shifts in market sentiment and make informed decisions.

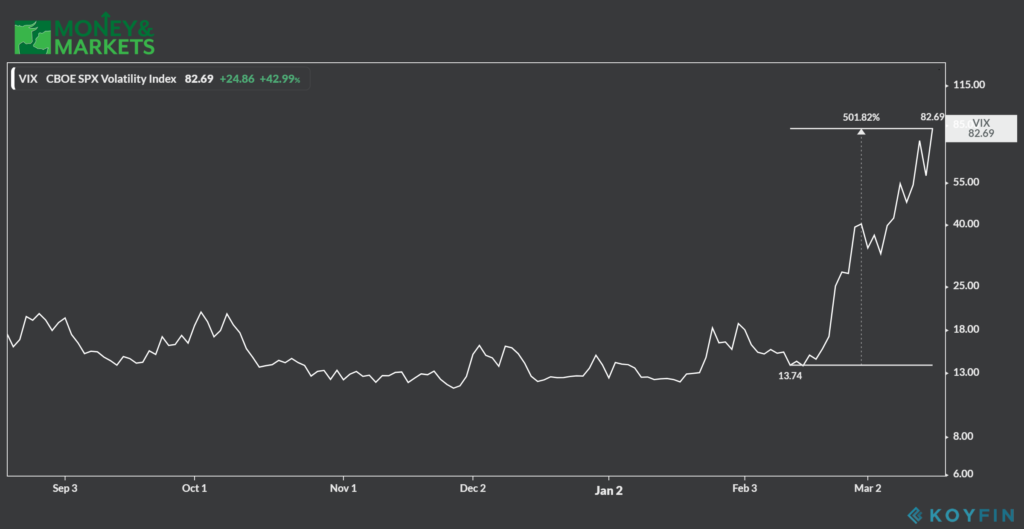

Analyzing VIX Data and Statistics

Data and statistics play a vital role in understanding VIX and its implications for financial markets. Reliable sources such as the CBOE and financial news outlets provide up-to-date VIX data for analysis, enabling traders and investors to make informed decisions.

Key VIX Statistics

- Average VIX level over the past decade: 19.2, offering insight into typical market conditions and volatility levels.

- Highest VIX reading during the 2008 financial crisis: 89.53, highlighting extreme market conditions and the significance of VIX as a risk indicator.

- Lowest VIX reading in recent years: 9.14, reflecting periods of market calm and stability, underscoring the importance of monitoring VIX levels.

Final Thoughts

In summary, the Volatility Index (VIX) is an indispensable tool for understanding and navigating the complexities of financial markets. By offering insights into market sentiment and volatility, VIX empowers investors and traders to make informed decisions and effectively manage risk. We encourage you to explore the topics discussed in this article further and apply VIX in your investment strategies to enhance your financial success.

Feel free to share your thoughts and experiences in the comments section below, and don't hesitate to explore other insightful articles on our website for additional guidance and knowledge.

References:

- Chicago Board Options Exchange (CBOE): https://www.cboe.com

- Investopedia: https://www.investopedia.com

- Journal of Financial Markets: https://www.sciencedirect.com